AI Questions and Answers

Exploring attractive fields for investors in the crypto space

In the world of cryptocurrency, there are always new and exciting projects popping up. With the industry constantly evolving, it can be challenging to know where to invest your money. In this post, we'll explore some of the most attractive fields for investors in the current crypto landscape.

The High Pipe analogy

Before diving into the specific fields, let's first discuss an analogy that the co-founder of Leon shared that perfectly describes the crypto journey. Imagine you take a small boat and venture out into the ocean. As you sail, you start to notice holes in the boat, and water begins to seep in. This is where the High Pipe comes in, as it makes you aware of the problems so you can fix them and become stronger to continue your journey.

Fields of interest for investors

One of the most attractive fields for investors in the current market is regenerative finance. This intersection between web 3 and climate, among other positive change areas, is where real-world problems are being solved. It's an area that's gaining attention from investors, and more funds are becoming available for these kinds of projects to thrive.

While regenerative finance is currently gaining momentum, there are other fields that investors find interesting, such as under-collateralized lending in DeFi, cross-chain bridges, and decentralized infrastructure and hardware. Liquid staking is also an area that investors are exploring, along with issues like tax reporting and transaction tracking.

The future of the crypto industry?

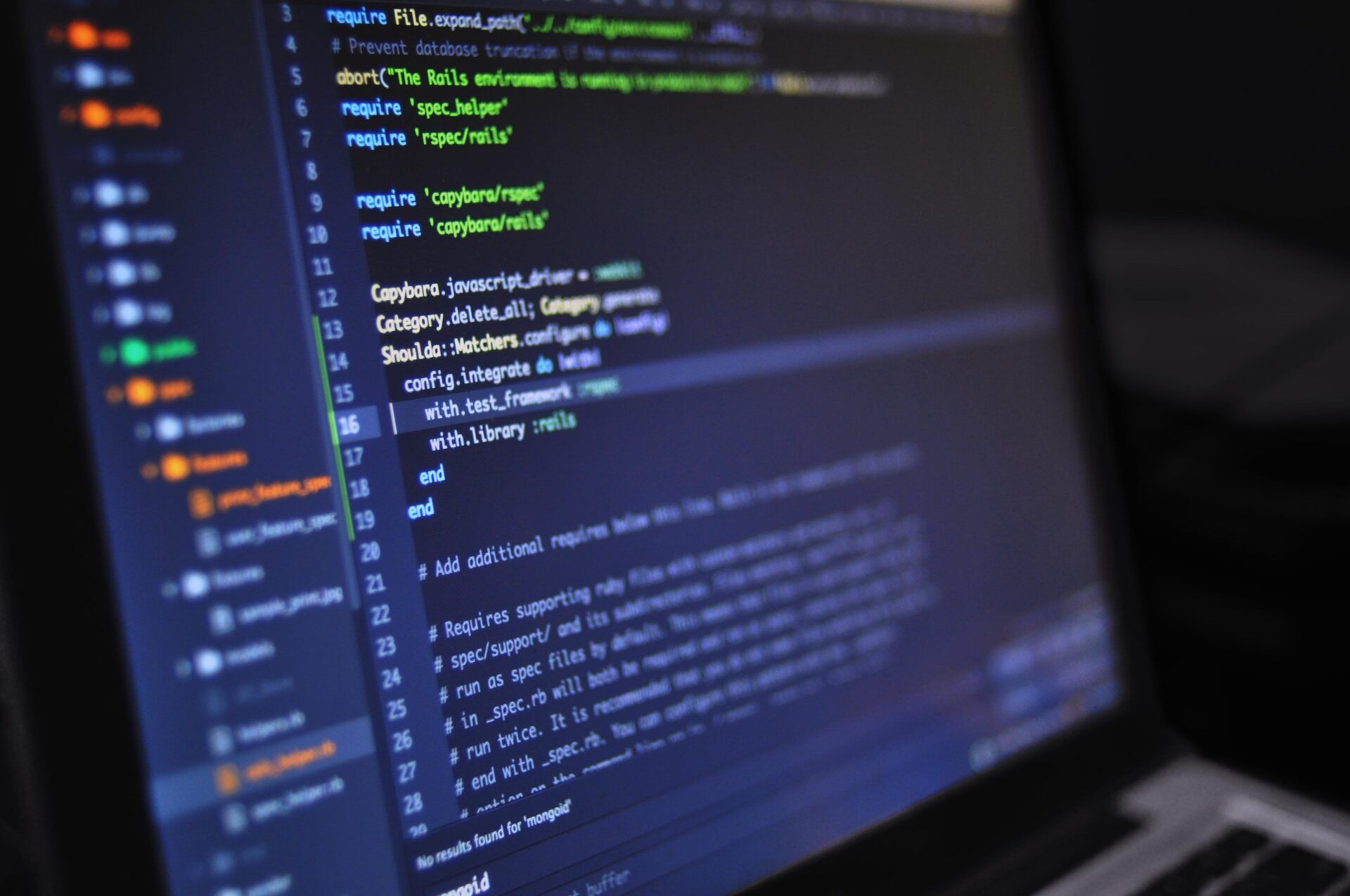

Although the current setup of Ethereum and Solidity has been revolutionary, there are still many holes in the system when it comes to security. The crypto industry needs to find ways to make DeFi more robust and secure for investors. For example, some solutions are being developed, such as the use of Rust programming language and layer-two solutions.

The crypto industry is constantly evolving, and investors need to be aware of where to invest their money. Fields like regenerative finance, under-collateralized lending in DeFi, cross-chain bridges, and decentralized infrastructure and hardware, are all areas that investors find interesting. However, the industry needs to find ways to make DeFi more secure and robust, and this is an area that's currently gaining attention from developers and investors alike.

What are your views?